Ach Processing Fundamentals Explained

Table of ContentsSome Known Incorrect Statements About Ach Processing Not known Details About Ach Processing Ach Processing for BeginnersThe Main Principles Of Ach Processing Not known Details About Ach Processing

Straight payments can be made use of by people, companies, and also various other organizations to send out cash. If you're paying an expense online with your financial institution account, that's an ACH straight repayment.The individual or entity receiving the cash registers it in their bank account as an ACH credit rating. Using ACH transfers to pay costs or make person-to-person repayments offers several advantages, beginning with comfort.

Not to mention you can conserve on your own a few dollars by not having to invest cash on stamps. In addition, an ACH settlement can be much more protected than other types of payment. Sending out and getting ACH settlements is usually fast. The negotiation of a deal, or the transfer of funds from one bank to one more via the ACH Network, normally happens the next day after it is initiated.

What Does Ach Processing Do?

ACH transfers are much more affordable when contrasted to wire transfers, which can range between $25 to $75 for international outbound transfers. Cord transfers are recognized for their speed and are often made use of for same-day service, however they can often take longer to complete. With an international cord transfer, as an example, it might take a number of company days for the money to move from one account to one more, then an additional few days for the transfer to clear.

There are some possible disadvantages to bear in mind when utilizing them to move money from one financial institution to another, send out payments, or pay costs. Many banks enforce limits on how much money you can send out using an ACH transfer. There may be per-transaction restrictions, daily limitations, and regular monthly or weekly limits.

The Of Ach Processing

Or one sort of ACH transaction may be unlimited yet an additional may not. Banks can additionally impose limits on transfer locations. They may forbid international transfers. Financial savings accounts are governed by Federal Get Policy D, which might limit particular kinds of withdrawals/transfers to 6 per month. If you go over that restriction with multiple ACH transfers from cost great site savings to another financial institution, you could be hit with an excess withdrawal penalty.

When you select to send an ACH transfer, the moment structure matters. That's since not every bank sends them for bank processing at the very same time. There might be a cutoff time by which you require to obtain your transfer in to have it refined for the following company day.

ACH takes approximately one to three company days to finish and also is thought about sluggish in the era of fintech and also instant payments. Same-Day ACH processing is growing in order to fix the sluggish service of the standard ACH system. Same-Day ACH volume increased by 73. 9% in 2021 from 2020, with a total of 603 million settlements made.

The 6-Minute Rule for Ach Processing

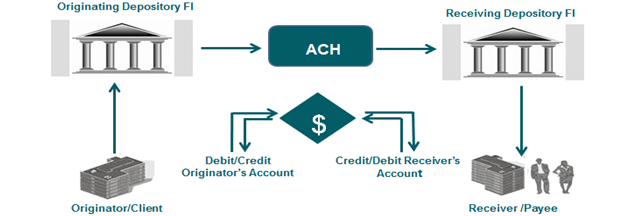

An ACH financial institution transfer is an electronic repayment made in between banks for repayment objectives. ACH bank transfers are utilized for many functions, such as straight deposits of incomes, debts for routine settlements, and cash transfers.

Both wire transfers as well as ACH purchases are utilized to promote the activity of cash. Wire transfers normally happen on the exact same day as well as cost more. ACH transfers usually take longer to complete; however, same-day ACH transfers are ending up being much more usual - ach processing. ACH is additionally for residential transfers whereas global transfers are done by cord transfers.

Not known Factual Statements About Ach Processing

Either way, see to it you understand your financial institution's policies for ACH direct down payments and direct settlements. Also, be vigilant for ACH transfer frauds. An usual scam, for instance, entails someone sending my site you an email informing you that you're owed cash, and all you need to do to obtain it is provide your checking account number as well as routing number.

Editor's note: This short article was initial published April 29, 2020 and last updated January 13, 2022 ACH represents Automated Clearing up House, an U.S. monetary network utilized for digital settlements as well navigate to this site as cash transfers. Understood as "direct repayments," ACH repayments are a method to move cash from one financial institution account to one more without making use of paper checks, credit card networks, wire transfers, or cash.

As a consumer, it's likely you're currently acquainted with ACH repayments, even though you may not be aware of the jargon. If you pay your costs digitally (instead of writing a check or getting in a credit rating card number) or receive straight down payment from your company, the ACH network is most likely at work.